What is business credit? In business, credit is essential for obtaining goods and services. For building business credit the EIN is used to:

Engagex ein number how to#

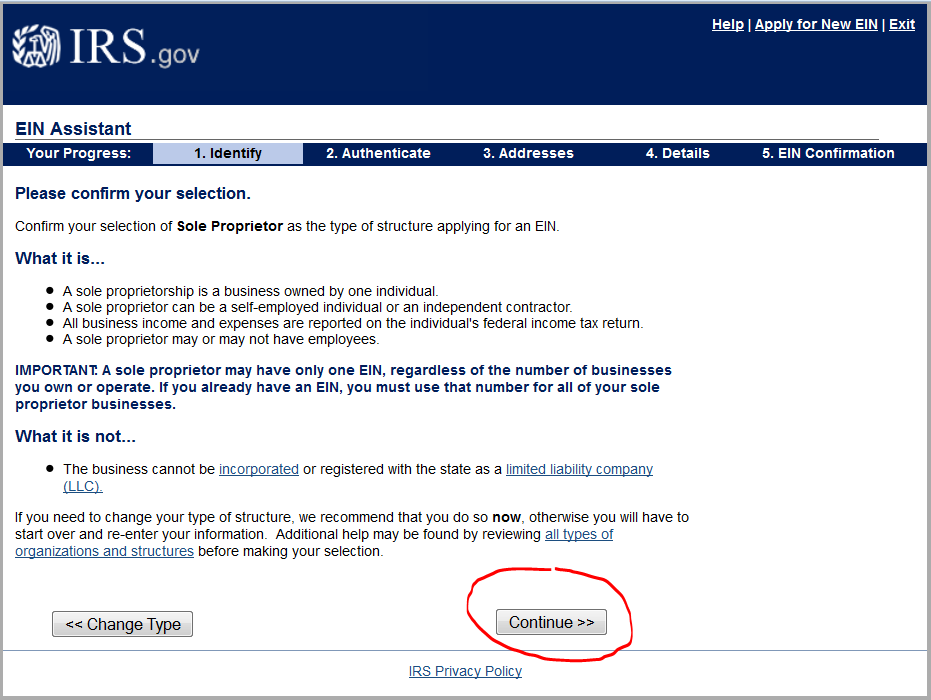

When learning how to open a business credit file, you’ll need an EIN number. How to establish business credit through your EIN? Try purchasing a business credit report from any of the major credit agencies. Paid Method of Finding an EIN For a Business If the business is a nonprofit you may locate it in the IRS tax exempt organization Search.

0 kommentar(er)

0 kommentar(er)